Bank of America "Forgets" to Ask for Promissory Note in Short Sale

We all make mistakes, but this was a big one, by a big corporation… I was in negotiations for a short sale on a Crestview, Florida listing. My sellers owed Countrywide/Bank of America about $175,000 as the senior lien and around $25,000 to Citi Financial as the junior lien. The sale price was a spot-on $150,000.

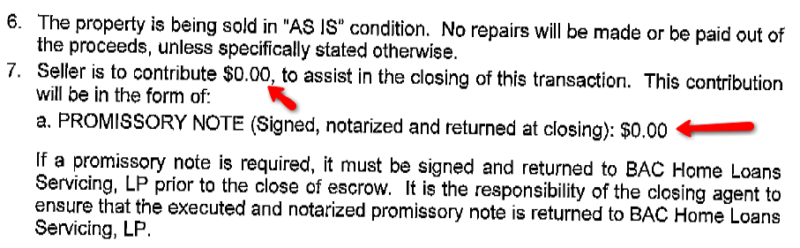

Bank of America asked for a promissory note of $5000. Although my sellers had recently divorced and had to move to separate homes, they both had stable jobs. Bank of America told me that was a factor in asking them for the note. The couple agreed, and I emailed the negotiator. A few weeks later, BOFA approved the short sale. YEA! And they did not even ask for a note!

My next problem was to tackle Citi, who had initially farmed out the listing to a collection agency, as I wrote about in “Rude and Crude- Nordon Collection Services”. After I complained about Nordon’s uncouth behavior, and hanging up on me, Citi took the file back. They requested $6000 as a pay-off to release their lien. BOFA would only pay them $3000, so my sellers agreed to pay the other $3000 at closing, each having to borrow money to do so.

Finally, the home closed! After months of wrangling, the sellers were thrilled to complete that phase of their lives.

Until yesterday, that is. Bank of America called asking where the note was. This is a month after closing. They sent me back a copy of my own email to them stating the sellers would agree to a note (pretty shrewd, huh?) The negotiator then called me, demanding the note be paid.

I responded, incredulously.”The note?” I said, “You did not require a note in your approval letter. The sellers based their decision to borrow money to pay Citi on the fact that you did not require a note. They have nothing more to give…. Is someone in trouble at your company?”

“Yes” he responded.

It’s Wendy!

Sign up For Short Sale Webinar with Broker Bryant and Wendy Rulnick

Wendy Rulnick, Broker, CRP, CRS, GRI, ABR Rulnick Realty, Inc.